housing allowance for pastors form

Pastoral Housing Allowance for 2021. As mentioned in Business Dictionary this is the definition of the housing allowance.

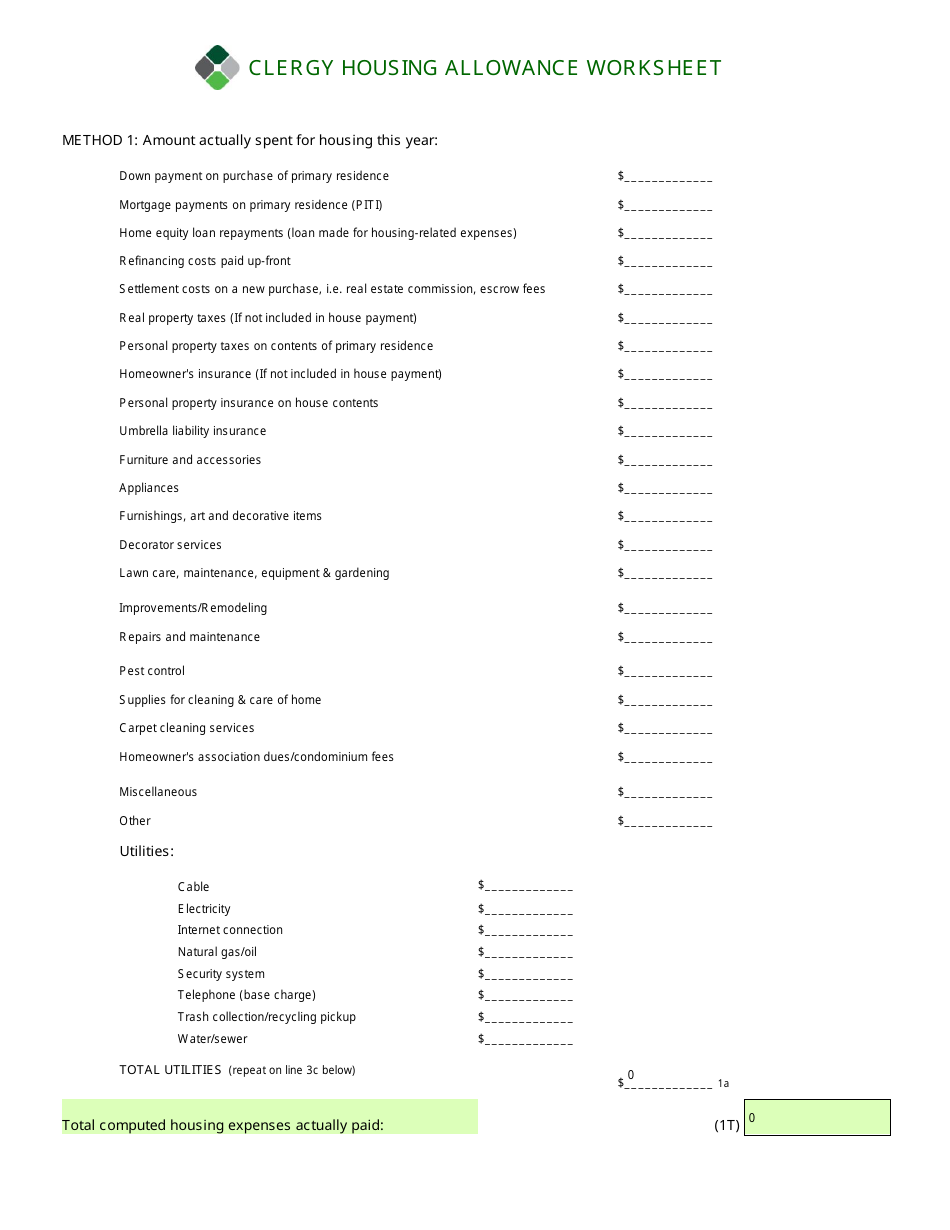

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Housing Allowance Clergy Allowance

At GuideStone we help active and retired ministers understand the benefits as well as the responsibilities of housing allowance.

. Resolved that the designation of Amount 00000 as a housing allowance shall apply to calendar year 20__ and all. Ordained clergy are not required to pay federal or state except in Pennsylvania income taxes on the amount designated in advance by their employer as a clergy housing allowance to the extent. The process described The process described above is similar to that used when completing Schedule A Form 1040 Itemized Deductions.

Building housing allowance into your tax strategy can create a stronger foundation for the years to come. And mirror the forms in the back of the PCA Call Package Guidelines just follow the links below. The amount spent on housing reduces a qualifying ministers federal and state income tax burden.

It is time again to make sure you update your housing allowance resolution. In this illustration there is a 3360 tax savingswith the Housing Allowance. Housing Allowance Calculation Form for Ministers Who Own or Rent Their Own Home This form is for helping ministers determine the appropriate amount to claim as housing allowance.

Church boards can use the language below to create a resolution for a pastor who owns or rents a home. October 8 2021. All other wages paid are reported on the W-2.

The church is not required to report the housing allowance to the IRS. Ready-to-use resolution language for church board to set a clergy housing allowance in 2022. This means the minister is exempt from social security and Medicare withholding but the minister is responsible for paying self-employment tax on his.

And it is further. Resolved that the total compensation paid to Pastor FirstLast Name for calendar year 20__ shall be Pastors Compenstation 00000 of which Amount 00000 is hereby designated as a housing allowance. A housing allowance is an annual amount of compensation that is set aside by the church to cover the cost of housing related expenses for its ministers.

If you have questions give us a call at 678 825-1198 to schedule an appointment with a Financial Planning Advisor. _____ For the period _____ 20___ to _____ 20____. Allowances for the members of the military and other job.

If your salary is 37500 and the housing allowance is 2500 for a total compensation of 40000. Here are four important things that you need to know concerning the housing allowance. Properly designated housing allowance _____B The amount excludable from income for federal income tax purposes is the lower of A or B or reasonable compensation.

IRC 107 is an amount that the pastor can elect out of the salary to cover housing expenses including expenses that a Housing Allowance does not cover if there is one. The eligible housing allowance amount is exempt from federal income taxes but not from self-employment taxes Social Security and medicare unless a minister has filed a Form 4361 and been approved to opt out of social security. The same goes for a housing allowance paid to ministers that own or rent their homes.

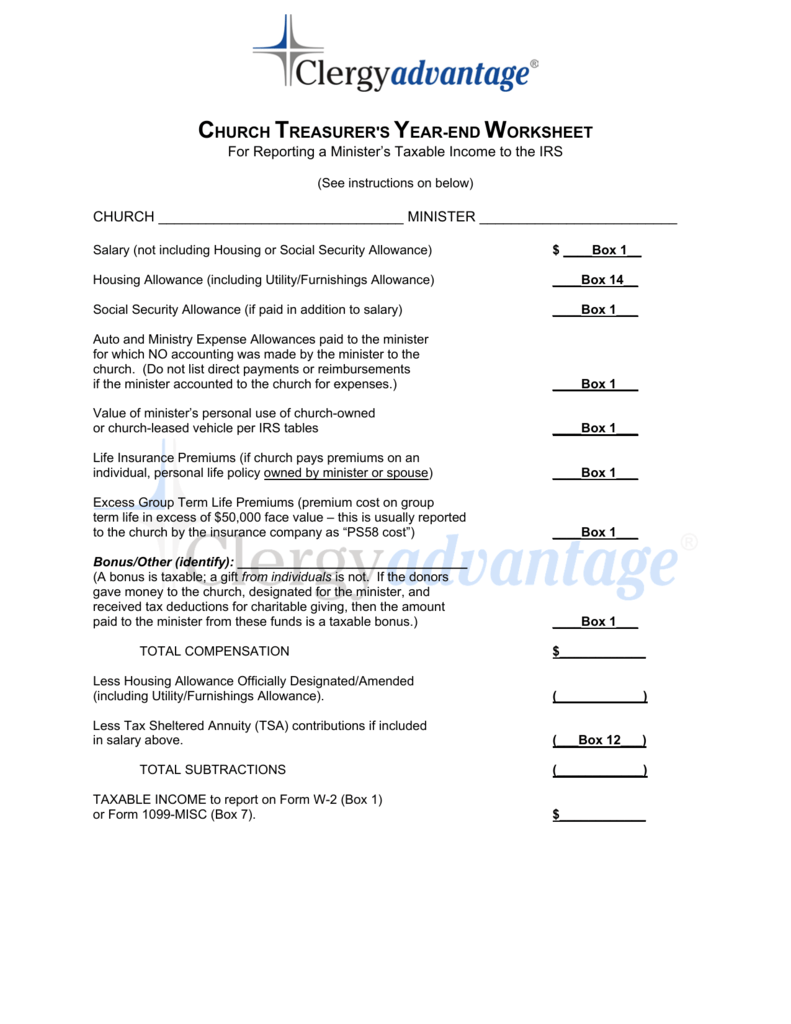

The total housing allowance payments can be reported in Box 14 which is simply an informational box for the employee. Clergy Financial Resources also offers Pro Advisor support for your housing and other tax questions. Pro Advisor I Tax Support.

Taxes with housing allowance Salary of 50000 Housing Allowance of 28000 Reduction of Taxable Income 50000 - 28000 22000 Taxed on 22000 12 2640 Owed income tax of 2640. Only expenses incurred after the allowance is officially designated can qualify for tax exemption. Not every staff member at the church can take this allowance.

Section 107 of the Internal Revenue Code IRC states that. Enter the 1099-NECs exactly as you received them - the IRS got a copy of the form that you received and will be expecting you to report the same figures on your return. This is an excerpt from my book The Pastors Wallet Complete Guide to the Clergy Housing Allowance.

From board of pensions as noted on IRS Form 1099R _____ 2-b Total officially designated housing allowance. Housing allowance amounts are not taxable on your income tax but are subject to taxation under self-employment laws. Sample Housing Allowance for Pastors.

This is not included in taxable income on the W-2. Section 107 of the Internal Revenue Code clearly allows only for ministers of the gospel to exclude some or all of their ministerial income as a housing. Owned by or Rented by the Church.

This may take different forms such as by resolution budget line item corporate minutes employment contract etc. Unless a church includes it in an informational section on Form W-2 the IRS and the Social Security Administration SSA are only made aware of the housing allowance when a minister files. Housing allowance - pastor getting a 1099 MISC.

Ad Clergy Housing Allowance Worksheet More Fillable Forms Register and Subscribe Now. Fair rental value of house furnishings utilities. The housing allowance for pastors is not and can never be a retroactive benefit.

Read on for more detail on the housing allowance for pastors and how to record it for tax purposes. The housing allowance is for pastorsministers only. Services that a duly ordained commissioned or licensed minister performs in the exercise of his or her ministry are generally covered under the Self-Employment Contributions Act SECA.

Minister for Tax Purposes eligibility. Minister Living in Housing. The pastor should keep a copy of this letter along with a copy of their certificate.

There is no special form for reporting a ministers housing allowance. Paid 9600 as a qualified ministers housing allowance This letter will alert the. Its suggested that you validate this number by checking with a local realtor.

This support service is available at a flat rate of 7500 for each 30-minutes session. HOUSING ALLOWANCE I understand that I assume full responsibility for compliance with IRS regulations and understand the need to keep an accurate record of housing expenditures in order to be able to substantiate any amounts excluded from gross income in filing my Federal Income Tax Return. Most ministers and Pastors are considered employees of the church so you would report their compensation on a W-2with the salary reported in Box 1 and NOTHING in boxes 345 and 6.

You may need to ask your treasurer for a corrected W-2. Total annual housing cost for calendar year 20_____. What is a housing allowance.

The amount reported in Box 1 of the 1099-NEC will be subject to income tax and self-employment tax. Therefore it is important to request your housing allowance and have it designated before January 1 so that it is in place for all of 2020. Box 1 is 37500 Box 14 is 2500.

The amount paid to the minister as a HA is not reported on the form W-2. In this 45-minute webcast you will learn about. 0 2 METHOD 3.

A Clergy W-2 from a church should show Salary in box 1 and the housing allowance in box 14.

Gehs Application Form Fill Out And Sign Printable Pdf Template Signnow

Housing Allowance Worksheet Fill Out And Sign Printable Pdf Template Signnow

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller

Clergy Housing Allowance Worksheet 2010 2022 Fill And Sign Printable Template Online Us Legal Forms

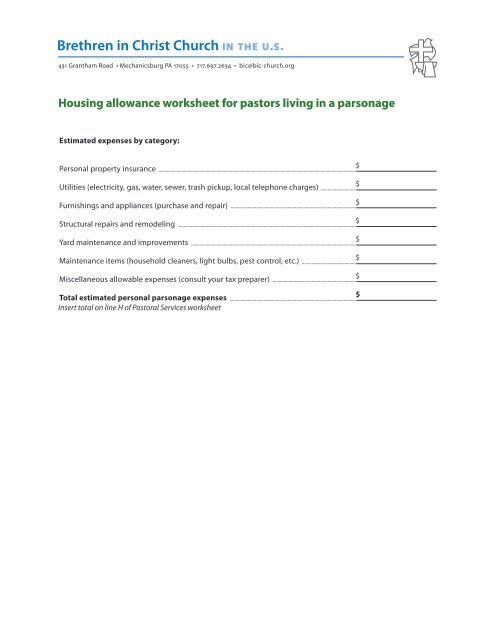

Housing Allowance Worksheet For Pastors Who Live In A Parsonage

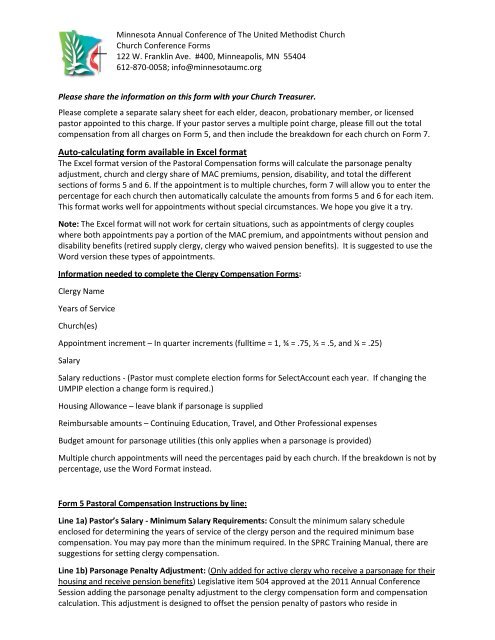

Forms 5 6 7 8a And 8b Clergy Compensation In Pdf Format

Fillable Online Agncn Housing Allowance Request Ncn Assemblies Of God Agncn Fax Email Print Pdffiller

Housing Allowance Worksheet Fill Online Printable Fillable Blank Pdffiller

Video Q A How Does The Housing Allowance Work Without A Mortgage The Pastor S Wallet

Church Treasurer S Year End Worksheet

Clergy Housing Allowance Exclusion Resolution

Minister S Housing Allowance A K A Parsonage Allowance

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller